Post Office Monthly Income Scheme 2025: The Post Office Monthly Income Scheme (POMIS) 2025 is one of the safest and most reliable small savings schemes offered by the India Post under the Government of India. This scheme is specially designed for individuals who want a fixed and regular monthly income with guaranteed returns. It is a great choice for senior citizens, retired employees, and people who prefer risk-free investment options with a steady flow of income. The scheme offers an attractive interest rate and is backed by the government, which means your money is completely safe.

Post Office Monthly Income Scheme 2025

The Post Office Monthly Income Scheme (POMIS) is a long-term government savings plan that provides a fixed monthly income in the form of interest to investors. When you invest a certain amount in the scheme, you receive monthly interest based on the current rate fixed by the government. It is an ideal investment option for people who prefer stable returns rather than market-linked risks. The investment period is five years, after which the total deposited amount is returned to the investor along with the final interest.

Post Office Monthly Income Scheme 2025 Overview

| Particulars | Details |

|---|---|

| Scheme Name | Post Office Monthly Income Scheme (POMIS) 2025 |

| Scheme Type | Small Savings Scheme |

| Organized By | India Post, Government of India |

| Minimum Deposit | ₹1,000 |

| Maximum Deposit (Single Account) | ₹9 lakh |

| Maximum Deposit (Joint Account) | ₹15 lakh |

| Lock-in Period | 5 Years |

| Interest Rate (2025) | 7.4% per annum (payable monthly) |

| Mode of Interest Payment | Direct credit to savings account |

| Official Website | www.indiapost.gov.in |

Features of Post Office Monthly Income Scheme 2025

- Guaranteed Returns: The scheme offers assured and risk-free returns as it is backed by the Government of India.

- Attractive Interest Rate: Investors earn a 7.4% annual interest rate, which is paid monthly, providing a steady income.

- Flexible Investment Options: The scheme allows both single and joint accounts.

- Maturity Period: The maturity period is five years, after which the investor can withdraw the amount or reinvest it.

- Transfer Facility: The account can be transferred from one post office to another across India.

- Nomination Facility: You can nominate a beneficiary to receive the benefits in case of an unfortunate event.

Eligibility Criteria for POMIS 2025

To invest in the Post Office Monthly Income Scheme 2025, you must meet the following eligibility requirements:

- The applicant must be an Indian resident.

- The minimum age should be 10 years to open an account in their own name.

- A guardian can open an account on behalf of a minor.

- Non-Resident Indians (NRIs) are not eligible to open this account.

Investment Limit

- Single Account: The maximum investment limit is ₹9 lakh.

- Joint Account (up to 3 adults): The maximum investment limit is ₹15 lakh.

- The minimum investment amount required to open an account is ₹1,000, and deposits must be made in multiples of ₹1,000.

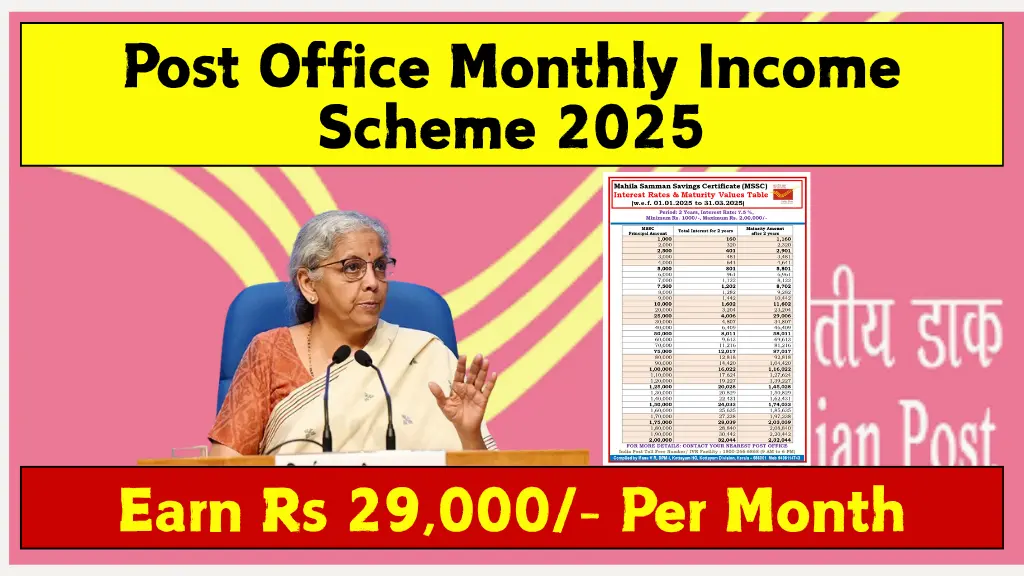

Interest Rate and Payment

The interest rate for 2025 under the Post Office Monthly Income Scheme is 7.4% per annum, which is paid out every month. The interest amount is directly credited to the investor’s post office savings account. The rate is revised by the Ministry of Finance every quarter, depending on market conditions and inflation rates.

Post Office Monthly Income Scheme Apply Online

- Visit your nearest post office branch.

- Collect and fill out the POMIS application form.

- Attach the necessary documents such as Aadhaar card, PAN card, and two passport-size photos.

- Deposit the investment amount through cash, cheque, or demand draft.

- Once the account is opened, you will receive a passbook with details of your investment and monthly interest.

You May Also Like

- Canada Open Work Permit 2026 Updated, Guide for Indian Job Seekers and Students

- Birth Certificate Apply Online, Download Birth Certificate Online For Every Age

- JKBOSE 12th Class Result 2025, Search By Roll Number and Namewise @ JKbose.nic.in

- SC ST OBC Scholarship 2026 Apply Online, Get ₹48,000 Scholarship for All Students

- JKBOSE 10th Class Result 2025 Date Announced, Check 10th Class Result Name Wise

Premature Withdrawal Rules

Although the scheme has a lock-in period of 5 years, you can withdraw the amount before maturity under certain conditions:

- If withdrawn before 1 year, no interest is paid.

- If withdrawn after 1 year but before 3 years, 2% of the deposit amount will be deducted as a penalty.

- If withdrawn after 3 years but before 5 years, 1% of the deposit amount will be deducted.

Benefits of Post Office Monthly Income Scheme 2025

- Safe and Secure Investment: Being a government-backed scheme, it carries no market risk.

- Fixed Monthly Income: It ensures a regular source of income every month.

- Suitable for All Ages: Ideal for pensioners, homemakers, and individuals with fixed income needs.

- Simple Process: Easy to open, operate, and manage through post office branches.

FAQs

The current interest rate for POMIS 2025 is 7.4% per annum.

The maturity period of the Post Office Monthly Income Scheme is 5 years.

Yes, premature withdrawal is allowed after 1 year, but a small penalty will be charged depending on the withdrawal period.

The maximum limit is ₹9 lakh for a single account and ₹15 lakh for a joint account.

The Post Office Monthly Income Scheme 2025 is one of the most reliable saving plans available in India. It is especially useful for individuals who want to earn a steady monthly income with guaranteed returns. With a competitive interest rate and the security of government backing, POMIS continues to be a preferred choice among small investors and retirees. Those looking for stable returns and long-term financial security should consider investing in this scheme through their nearest post office.